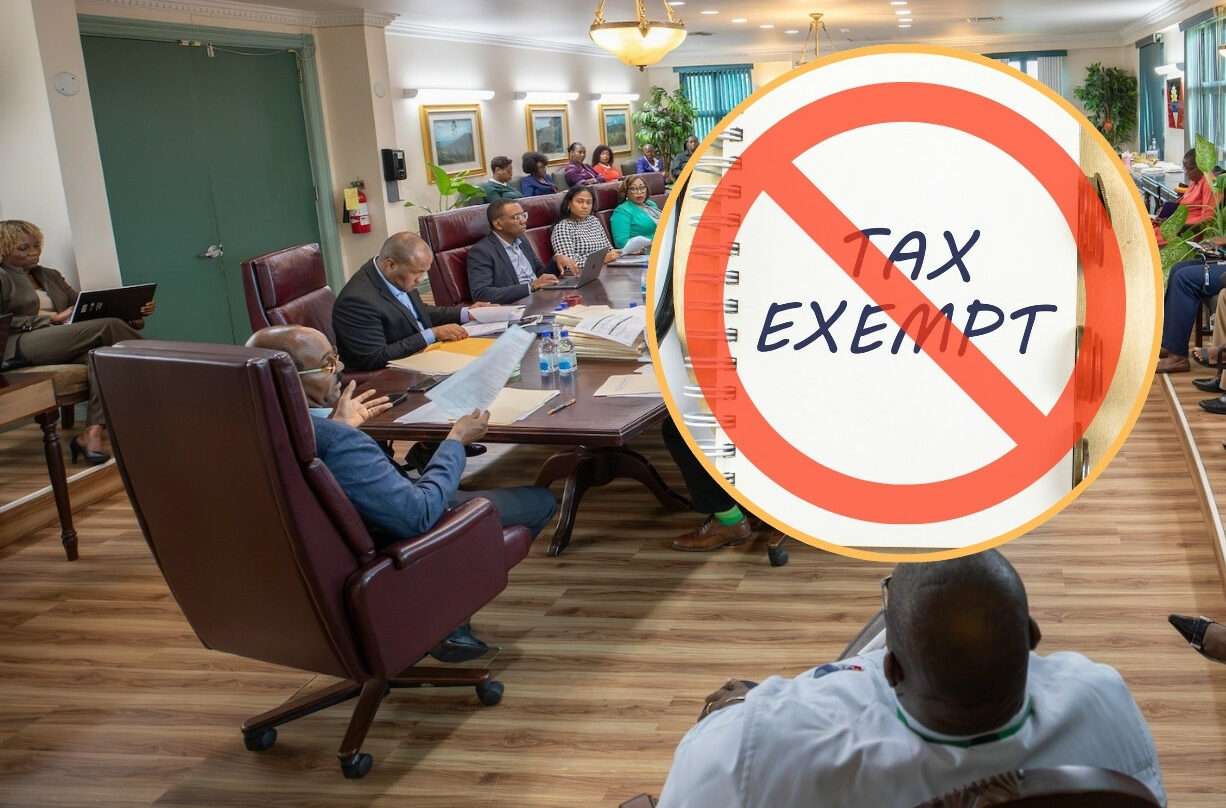

Businesses across Antigua and Barbuda will have to reapply to Cabinet for tax exemptions come December 1st as Cabinet announced its intentions to end concessions on November 30.

Cabinet Spokesperson Maurice Merchant explained the reasoning behind this move.

“The Government wants basically to review existing concessions to ensure they align with current economic priorities, sustainable development goals and investment strategies.

“It also allows Cabinet to reassess which sectors or projects truly need support,and which can operate without tax concessions. Also, the Cabinet believes that the recall or the cancellation of all these duties and taxes or concessions will promote fair competition. In addition, it will encourage compliance and accountability.

Director General of Communications Maurice Merchant

“The need for reapplication will ensure that businesses and projects meet updated criteria and adhere to proper regulations. It also strengthens transparency and accountability in the allocation of tax benefits. It also lends to strategic economic planning whereby it gives Government an opportunity to align incentives with long-term national goals such as green energy, tourism diversification, health and education development.

“It also allows the Cabinet to phase out concessions that no longer serve the country’s interests and so, we will have further developments as the time for the cancellation of these concessions draws closer,” Merchant detailed.

So peter paying for Paul ? Is that what it is? Real real serous shake up+! What a thing!!!

Good cause sometimes they get the concessions but the ordinary man don’t get the benefits of that which I’m sure is is one of the reasons that its granted in the first place

I wonder if the government will publish the list of companies currently benefiting from concessions. The public deserves to know

They said, one bad apple will spoil the whole basket. This major shake up is needed. I just feel like the public deserves to have a clear image on this

Ending old concessions could create fair competition. Some companies have been operating with advantages that others don’t get, this is a chance to reset.

Why the rich with million not paying their fair share of taxes WE know is part of the under the table deal when the start up but goodness take us out of poverty, fix roads, build new schools, nursing homes for the elderly who paid their fair share of taxes, LET THEM PAY GASTON CHANGE THE DEAL THE FIRST 2 YEARS THEN YOU PAY.

Some big companies have been living off concessions while small local businesses pay full taxes. Level the playing field!

Great move if it’s handled transparently. But we all know “reapply to Cabinet” can mean favoritism if not done right.

Excellent idea time to cut off those who exploit concessions and never deliver promised jobs

Finally, some accountability let’s see which companies really deserve the tax breaks