Prime Minister and Finance Minister Gaston Browne has disclosed that two additional offshore banks are expected to be placed into administration shortly, with the possibility of liquidation if their financial challenges are not resolved.

Speaking on the weekly Browne and Browne programme, Browne said one offshore bank, the Global Bank of Commerce is already in administration and that regulators are closely monitoring two others facing similar difficulties.

“If they cannot resolve the difficulties and trade out of administration, then evidently they’ll be placed into liquidation and wound up and struck off the books,” he explained.

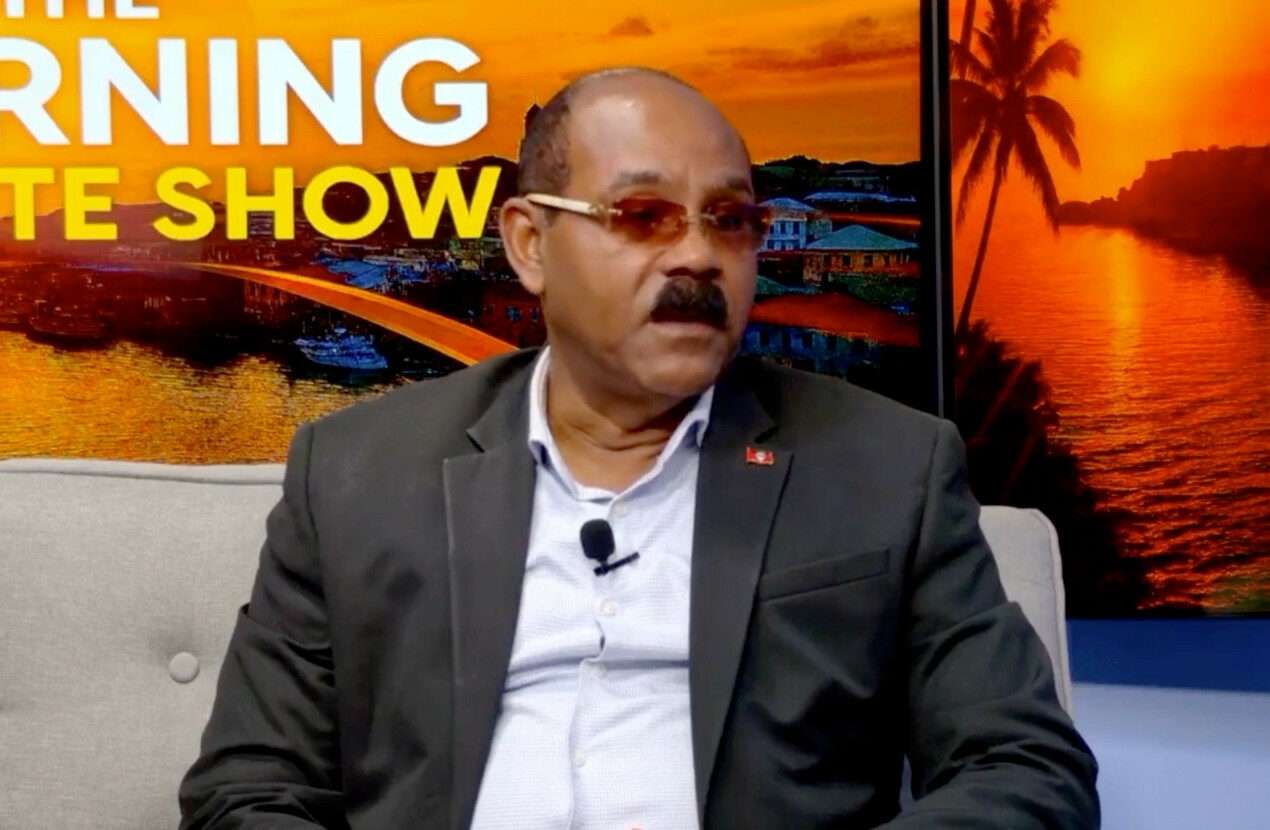

Prime Minister Gaston Browne speaking on Pointe TV (screenshot of Pointe FM)

The Prime Minister noted that the total asset base of all offshore banks combined is approximately US$1.5 billion, emphasizing that the sector has already undergone significant contraction and reform in recent years.

He said the government’s objective is to ensure a “pristine” financial services sector, free from regulatory weaknesses or vulnerabilities that could expose the country to reputational risk.

Browne stressed that authorities are taking proactive measures to strengthen supervision and enforcement, particularly within the offshore banking space. He added that Antigua and Barbuda will not allow weak institutions to undermine the jurisdiction’s standing.

The Finance Minister maintained that decisive regulatory action reflects strong leadership and a commitment to safeguarding the integrity of the country’s financial system.

That is because these offshore banks were in the wrong hands

These safeguards should have been in place monitored from day one. Now he’s scrambling at the eleventh hour?

These safeguards should have been in place from day one and monitored. Now he’s scrambling to fix this?

RIGHT NOW WE HAVE TO MAKE SURE WE TIGHTEN EVERYTHING.

LOOK BAD BUNY GO AND PUT US IN THE SPOTLIGHT NOW UNCLE TRUMP MORE VEX CAUSE WE GETTING ATTENTION

The PM right on one thing weak institutions does mash up whole country name.

If them can’t meet the rules, shut dem down clean. We cyaan play with international reputation again.

Financial oversight should’ve been tight from the start. Cleaning up after the damage is already done hurts confidence.

So all now them offshore banks still shaky? If dem can’t meet the standard, close dem down. Antigua cyaan afford no more black eye internationally.

Strong leadership is not just talking is action. Once the small man bank strong and safe, that’s what matter most.

Every few years is offshore bank story. At some point we haffi ask who approving dem in the first place?

Every few years is offshore bank story. At some point we haffi ask who approving dem in the first place?

Can we get an interest rate adjustment in the Countries that use XCD cause all these other countries wouldn’t let these horrible rates take advantage of people but we do down here, can’t even invest properly cause we don’t have a trade agreement with the US, they don’t want anyone who doesn’t know someone in power to have money.

Strong leadership is not just talking is action. Once the small man bank strong and safe, that’s what matter most.

Wait, this is the Bank where public funds were? Where Young was in court, unable to pay Jack Stroll back his money? The same DAWG who told the public that Stroll couldn’t get his money because the funds were tied up in national development? Where allegedly the Barbuda Irma one million dollars relief fund was? We are a special people here in Antigua. So absorbed in political party, we quickly forget the stupid, idiotic utterances of the clown controlling the public purse. What does the closure of GBC mean for public funds?

The fact is, under this fool, Antigua and Barbuda continues to sink into oblivion.