Last week, the Swiss Federal Administrative Court ordered FINMA to serve all documents related to the procedure that led to the write-down of Credit Suisse’s AT1 bonds.

As is well known, on March 19, 2023, in a truly surprising and unexpected decision that created a lot of turbulence in the markets, FINMA ordered the write-down of Credit Suisse Group’s AT1 bonds worth CHF 16 billion throwing small and large investors around the world into despair.

This measure had been taken in the context of the Swiss government’s decision to rescue Credit Suisse through a forced merger with UBS, which took over Credit Suisse at a very low price and stripped it of 16 billion CHF of AT1 debt.

Against this unbelievable decision, investors revolted by filing a request with the Swiss Federal Administrative Court to void FINMA’s decision because it lacked a legal basis, was discriminatory (with respect to shareholders and other bondholders), inadequate for its purpose (because it was unsuitable for solving Credit Suisse’s problems), disproportionate and detrimental to the guarantee of property rights protected by the Swiss Constitution.

As if that were not enough, FINMA created no small obstacles for investors who were determined to seek justice, as the Swiss regulator had so far refused to serve the bondholders with copies of the decision ordering the write-down of the AT1 bonds.

Investors were thus forced to file their appeals (over a thousand) without even knowing the details of FINMA’s decision. This incredible lack of transparency on FINMA’s part had the flavor of unfair conduct intended to discourage bondholders from claiming their rights in court. The Swiss Federal Administrative Court, however, recognized the rightfulness of the bondholders and, as mentioned, ordered FINMA to deposit all the documents making them available to the plaintiffs.

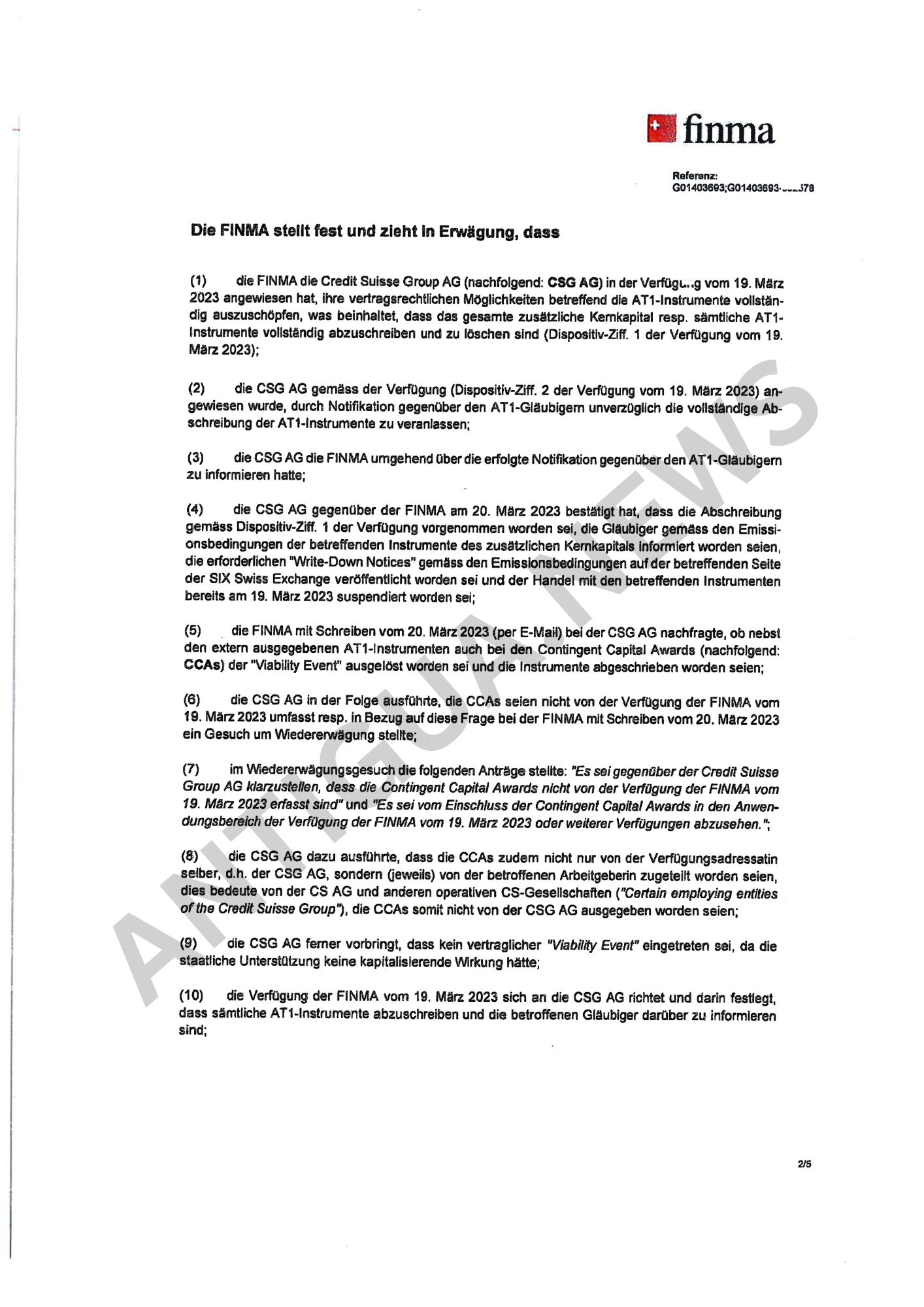

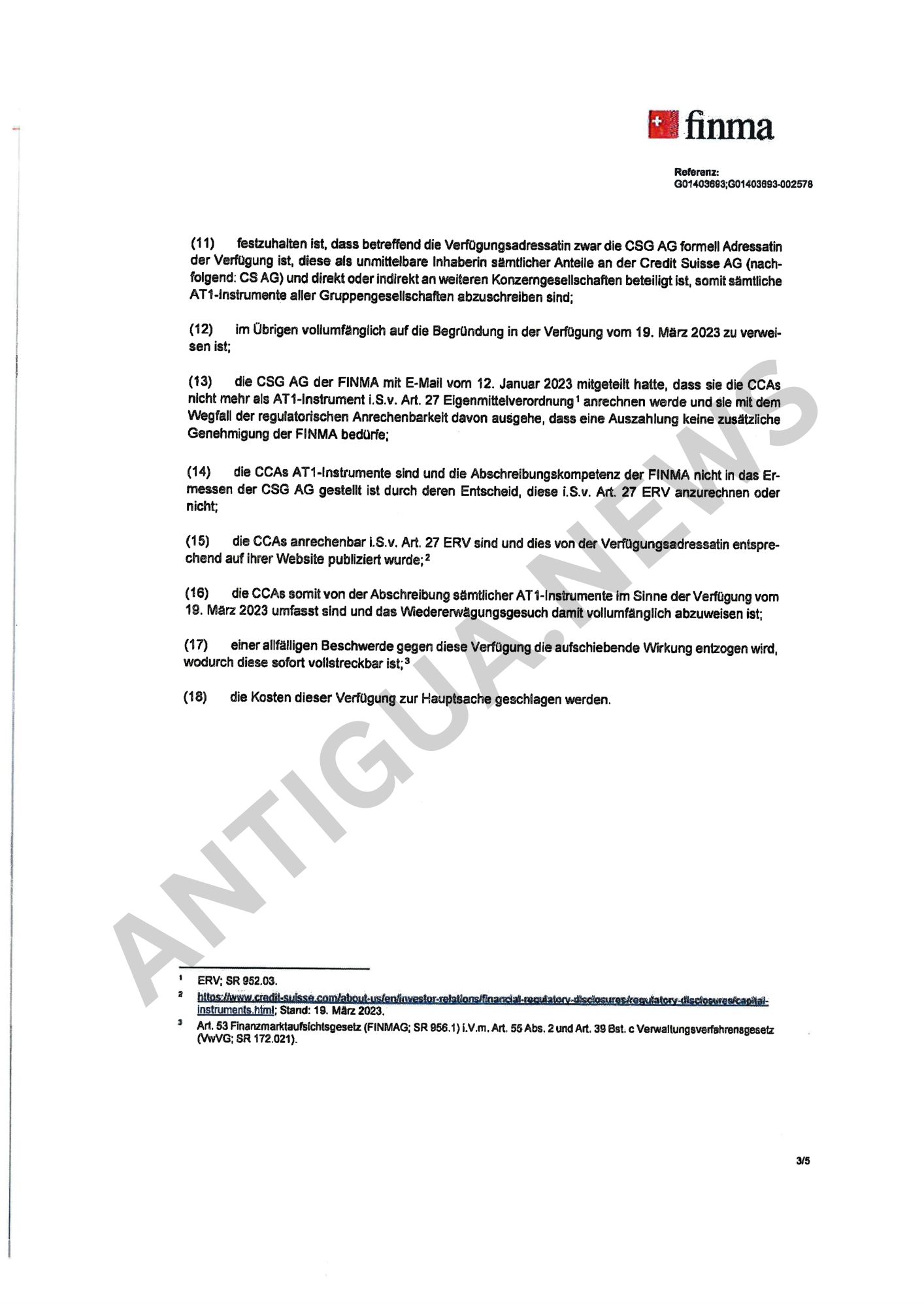

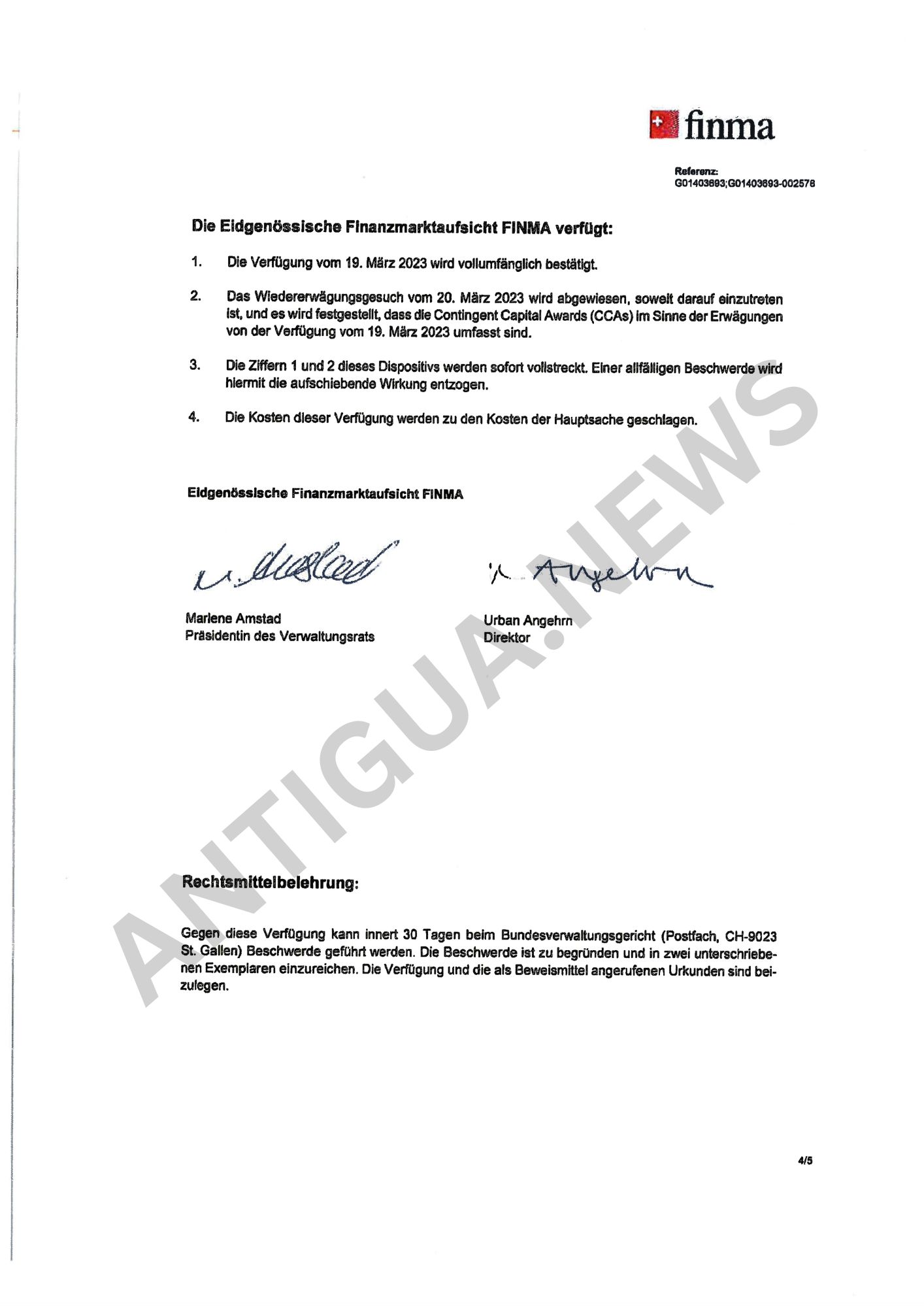

Thus, for the first time, details of both the March 19, 2023 decision and the March 22 decision thereafter were disclosed. Antigua.news makes these two decisions public.

Both decisions have surprising content.

The March 19, 2023 decision reveals a striking contradiction between the state of health of Credit Suisse as described by FINMA and what had been stated by management and the Swiss government shortly before the fateful date of March 19.

FINMA wrote in its March 19 decision that since the beginning of March 2023, in connection with the banking crisis in the United States and the related loss of confidence, Credit Suisse had again experienced a negative trend in deposit withdrawals, which became more pronounced as of March 13/14, 2023.

In an interview with Bloomberg on March 14, Ulrich Körner (CEO of CS) had stated instead that Credit Suisse had experienced a good inflow of client funds on Monday, March 13. Körner had also stated that the liquidity situation had improved since the end of 2022, with the liquidity coverage ratio rising from 144 to 150. These statements led to an (illegitimate) increase in CS’s share price on the stock exchange.

But the inconsistencies do not end there. On Wednesday, March 15, FINMA and the Swiss National Bank announced that CS was well-capitalized and had sufficient liquidity. However, in the March 19 decision, FINMA states that the bank had just reached its internal liquidity limit at the Swiss National Bank in mid-March 2023, and a shortfall below this level indicates a risk that the bank will no longer be able to properly execute payment transactions.

What’s more: on March 16, CS issued a press release stating that the bank had received CHF 50 billion in liquidity from the Swiss National Bank by resorting to Emergency Liquidity Assistance (ELA).

This statement had also been repeated several times by Federal Minister Karin Keller-Sutter. This financial rescue instrument must be secured by collateral and has a very low cost for the bank (0.5% spread).

The truth is that instead of CHF 50 billion, CS had received only CHF 39 billion in this capacity (because it had been unable to provide adequate collateral), but this had not proved to be enough.

For this reason, Credit Suisse had to borrow another CHF 20 billion but this time using the ELA-Plus rescue facility, which is much more expensive for the bank (3% spread). This misinformation spilled over into the markets, causing the CS share price to rise again, which instead would probably have fallen had it been known that CS no longer had collateral to offer to obtain new liquidity.

The 3/22/2023 decision also proves particularly interesting. It is the consequence of a request by Credit Suisse to FINMA to reconsider the order contained in a letter dated 3/20/2023 to also write down instruments called Contingent Capital Awards.

In its considerations, Credit Suisse had also raised the objection that there would be no contractual basis for a write-down. Indeed, the bank had argued that the government aid did not constitute a “viability event” within the meaning of the prospectus because it did not result in increased capitalization of the bank. Such appears to be the view expressed by attorney Markus Diethelm (Group General Counsel of Credit Suisse), who stated that he considered the write-down of the AT1s to be absolutely illegitimate, just as it appears that this stance was also communicated to the bank’s employees, who were affected by FINMA’s willingness to write-down the Contingent Capital Awards as well.

All this would explain why the Swiss government, in the absence of a solid contractual basis, had to resort to so-called emergency law by issuing an ad hoc rule (art. 5a PLB-NVO), with retroactive effect, to implement the write-down of the AT1s.

A rule that has the flavor of expropriation without compensation to the detriment of a single category of investors and whose constitutional legitimacy is now being examined by the Swiss Federal Administrative Court.

At stake is the Swiss Confederation’s credibility as a state governed by the rule of law and, above all, as a country capable of providing adequate guarantees of fairness and transparency to foreign investors.

Shaneful. They are criminals !

Lehman Brothers is a trade name, a worldwide ripple effect still going through restructuring and timely market transactions and legal processes in targeted jurisdictional bottlenecks that will make the world realize what this is all about.

No more tremors. No more loops of Fed injection mania and doom, actual merchant banking solutions > better access to the people, better investment and returns for beneficiaries. Just wish I was in Canada with Canadian residency. The hurdles we leap to re-route our cash into really undervalued and general public unaware of opportunities.

Why do we always assume these firms must incorporate and register / follow just US regulatory laws and commercial/accounting practices? The global market is solving itself without a government or private sector backstop.

LB lives. Whatever entity it is – failure… I think not.

Unaware – but discoverable. Hurry up people and find it.