By Aabigayle McIntosh

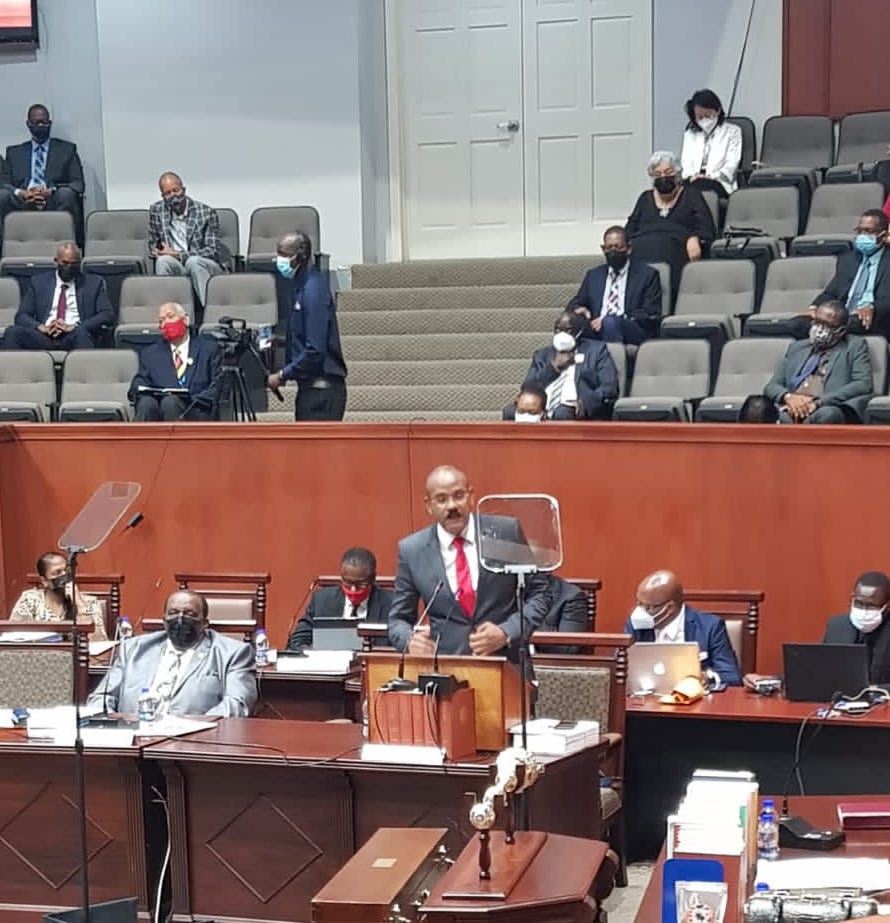

The Prime Minister of Antigua and Barbuda has discarded a recommendation from a team of professionals from the Minister of Finance for the re-introduction of the Personal Income Tax (PIT) as a means to increase the government’s revenue intake.

Financial Secretary Rasona Davis Crump said recently that this was among a raft of measures that were submitted, however, the government is leaning towards a two percent increase in the Antigua and Barbuda Sales Tax (ABST).

“Philosophically, my administration does not believe in taxing personal income, we believe that individuals should be encouraged to have strong disposable income so that they can increase their savings and ultimately investments,” Browne said.

He notes that he conducted a study back in 2013 in which he observed that the years the country was under the PIT the country recorded a reduction in its growth rate.

“You would have noted that after COVID, which we were significantly impacted, the rate of growth since 2020 would have increased exponentially we are now about 8 percent to around per annum, and we are sure this is because people have responded, they are spending more and as a consequence of that increase spend, we are seeing economic activity,” he adds.

The nation’s leader is insisting that the increase in ABST is the most practical approach there is, he also maintains the ABST is the most viable tax to as it also incorporates visitor spend.

“The two percent ABST is now burdensome it would not even increase the tax burden by 1 percent, probably about 7 percent of the overall tax base. From that standpoint, we think it is very reasonable, so if you have to pay an extra $1 or $2 at the supermarket, I think it is important from the standpoint of the government to ensure it can meet its obligation,” Browne added.

How is a ‘Sales Tax’ not taxing income??? Do they think we’re idiots? Well maybe we are after all. We have people who make less than the Taxable Income Threshold of $3500.00 complaining about paying income taxes. Guess what? It is the rich and Upper Middle Class that are served by the lack of a PIT! The poor people are paying the same Sales Tax rates as the rich and untra rich. Think about that. So your pittance of a salary is wiped out in no time when you’re paying a 17% sales tax on taxable goods. The rich? They bring in their stuff for free at the port with their duty-free concessions; and still get to avoid paying sales taxes and PIT!!! It’s a win/win for them!🤷

Not only on goods will be paying the 17%, it will be on services to, like APUA water, electricity, phone and internet. Antigua and Barbuda people need to wake up. With the increase in Social Security coming in January 2024, they’re going to cry blood. Gaston is going to clean us lower class people out coming January and enrich himself.

Don’t squeeze the poor, for the Lord will squeeze the life out of you if you do so. Proverbs 22: 22-23