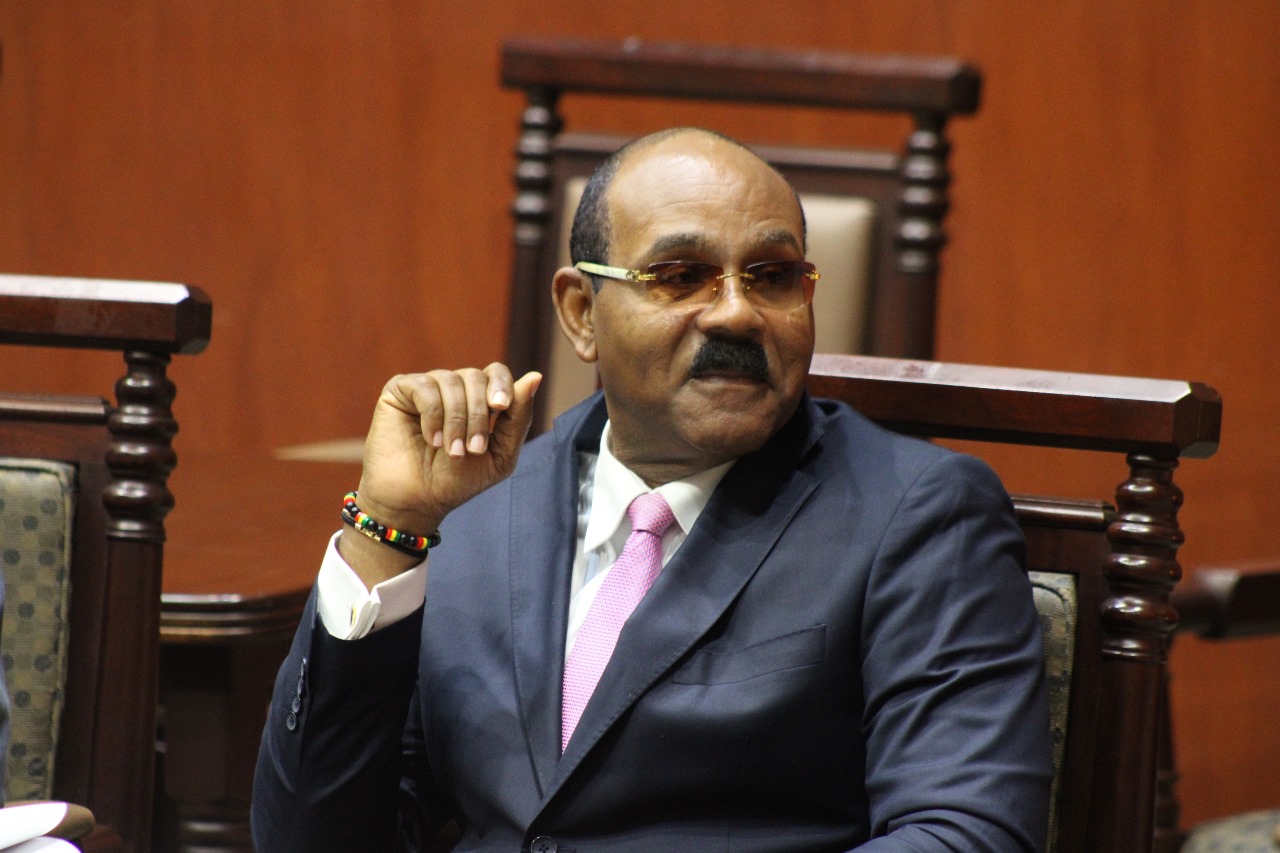

Timothy Antoine, the Governor of the Eastern Caribbean Central Bank

The Eastern Caribbean Central Bank (ECCB) is making significant strides toward acquiring the legal authority to approve and reject fees imposed by commercial banks within its currency union. Recent developments indicate that the harmonized banking amendment bill has been successfully passed in both Antigua and Barbuda, as well as St Vincent and the Grenadines.

Governor Timothy Antoine of the Eastern Caribbean Currency Board has highlighted that the next crucial step in this process is the establishment of an Office of Financial Conduct and Inclusion. This initiative aims to bolster consumer protection and ensure fair practices within the banking sector.

Antoine further noted that amendments to the banking act are in progress across other member countries, which will empower the ECCB to not only approve and reject banking fees but also to address customer complaints regarding specific banking transactions.

This move is expected to enhance transparency and accountability in the financial services sector across the region, thereby fostering trust in the banking system.

As the ECCB continues to collaborate with its member nations on this important endeavor, the potential for improved regulatory measures stands to benefit consumers and promote a more equitable financial landscape within the Eastern Caribbean.

I think this is a very bad idea. In what other private industry does the governing body has the authority to dictate how much the business charges for their service. The Eastern Caribbean Banker Association and the Caribbean Association of Banks needs to fight this with every dollar they have. It is complete opposite of a free market economy.

Well done ECCB. With rights come responsibility. Not because an entity can, they should, especially when the only justification is a wider profit margin. I am sure the oversight committee will be fair in its dealings. The public expects fees, but they must be fair and justified.

THANK YOU, JESUS, because some of these banks are extremely WICKED.

The customer service review is overdue. Customers are investing in long-standing no-interest lines for hours to do their banking.. The tax on Pensioners’ savings or cheque accounts needs to be removed. Fair and equal loan offers need to be implemented. Better waiting room facilities for elderly customers. They need to get rid of this awful ‘Welcome Home’ introduction at the Grenada Cooperative Bank, because calls are never answered. ‘Home’ seldom opens its door to a call.

Finally! Banks shouldn’t have free rein over fees. The ECCB’s watchdog role is a win for everyday people.

As someone working in the sector, I hope this leads to more transparency across the board, but I also hope they engage the banks directly before rejecting fees.

Sounds good on paper, but will this office really have teeth? I’ve seen too many ‘consumer protection’ promises that go nowhere.