You can now listen to Antigua News articles!

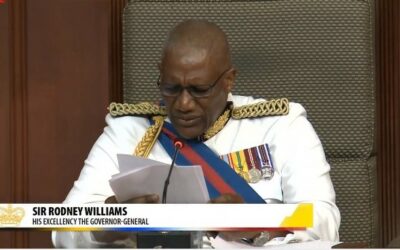

Professor C. Justin Robinson

As Antigua and Barbuda approaches the 2025 Budget Statement, we at The UWI Five Islands Campus present the highlights of the 2024 Budget Statement as part of the context for the 2025 budget statement.

Revenue Overview

Antigua and Barbuda’s 2024 Budget projected total revenue at $1.2 billion EC (18.7% of GDP), up from 2023’s $971.4 million, with tax revenue contributing the largest share. Here’s the 2024 projected breakdown:

- Tax Revenue (86% of total revenue):

- Direct Taxes: $156.5 million (13.0% of total revenue)

- Corporation Tax: $108.3 million (9.0%)

- Property Tax: $39.6 million (3.3%)

- Indirect Taxes: $853.1 million (71.0%)

- ABST (Antigua and Barbuda Sales Tax): $413.6 million (35.0%)

- Revenue Recovery Charge: $109.9 million (9.2%)

- Import Duties: $146.4 million (12.2%)

- Direct Taxes: $156.5 million (13.0% of total revenue)

- Non-Tax Revenue (14% of total revenue):

- Citizenship by Investment Programme (CIP): $130 million (10.8%)

Expenditure Overview

The 2024 Budget estimates total expenditure at $1.3 billion EC (20.3% of GDP), up from $1.1 billion in 2023 distributed as follows:

- Recurrent Expenditure (87% of total expenditure):

- Wages and Salaries: $461.1 million (35.5%)

- Transfers, including pensions and social security contributions: $295.6 million (22.7%)

- Interest Payments: $131.9 million (10.1%)

- Goods and Services: $210.6 million (16.2%)

- Capital Expenditure (13% of total expenditure):

- Infrastructure Development: $130.6 million (10.1%), including:

- Road rehabilitation: $82.8 million

- Building repairs: $33.5 million

- Infrastructure Development: $130.6 million (10.1%), including:

Major Policy Measures

The 2024 Budget outlined several fiscal policy measures to enhance revenue collection and manage expenditures effectively:

- Revenue-Generating Measures:

- Increase in ABST rate from 15% to 17%, with the tourism sector’s rate increasing from 14% to 17%.

- Broadening the ABST tax base to include online streaming services.

- Excise tax introduction: 10% on alcohol, tobacco, and cannabis products.

- Increase in the Money Transfer Levy from 2% to 5%.

- Property tax adjustments for properties valued at $3 million or more.

- Expenditure Management:

- Targeted infrastructure spending, focusing on roads and public buildings.

- Salary increases for public servants, completing a 14% increase over three years.

- Strategic Investments:

- Expansion of renewable energy projects, including a $100 million solar and LNG facility.

- $80 million expansion of UWI Five Islands Campus to bolster education.

- Social Support Measures:

- Maintaining subsidies on public transport and LPG gas, costing over $16 million.

- Increases in pensions for retired public servants.

Prof. C. Justin Robinson

Pro-Vice Chancellor and Principal UWI Five Islands

This is not enough if we are depending heavily on tourism. Good infrastructure especially the roadways, constant running water and good healthcare will attract more tourists.

Capital Expenditure:

Infrastructure Development: $130.6 million (10.1%), including:

Road rehabilitation: $82.8 million

Building repairs: $33.5 million

The PM needs to put more money into these ministries.