You can now listen to Antigua News articles!

A tower of lies at all levels harmed the investors, but the Public Prosecutor's Office of Canton Zurich says there was no fraud

Axel Lehmann (L) and Ulrich körner (R)

By Dario Item

This is the story of an investor who, like many others, was deceived by the Credit Suisse AT1 affair.

Julian (fictitious name, known to the editors of antigua.news) is a risk management expert and has a longstanding open banking relationship with Credit Suisse in Zurich. Through Credit Suisse, he frequently trades on the stock market.

On March 16, 2023, he wrote to his relationship manager at Credit Suisse telling him that he would like to invest in AT1 bonds and asked him to find some Credit Suisse AT1 bonds that were priced at a discount to their nominal value. He has analyzed the situation and read all the statements that had been made public up to that moment by the CEO (Ulrich Körner) and the Chairman (Axel Lehmann) of Credit Suisse Group, as well as by FINMA, the SNB, and Swiss Finance Minister Karin Keller-Sutter. In light of what he read, the panic in the markets seemed exaggerated to him.

His relationship manager’s response was not long in coming and only reinforced his convictions. Indeed, he wrote in an e-mail (copying one of his CS colleagues) the following:

Dear Julian,

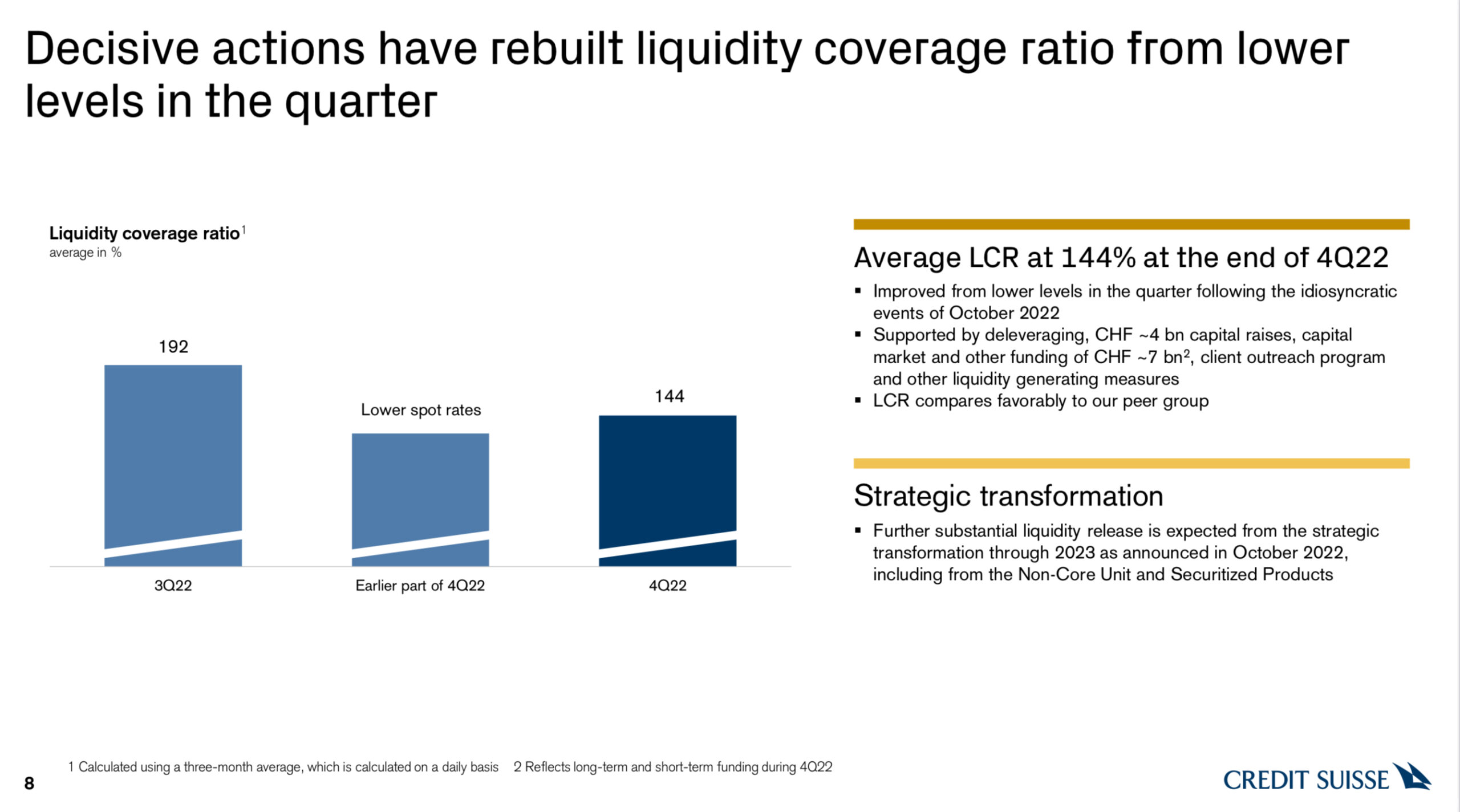

What a week !! I still struggle to understand this movement of stress (I will highlight it in an incoming extensive email). Fundamentally speaking, CS ratios are among the best in the world and, at least on our side, we have seen material outflows in Q1. In between LCR even improve from 144 to 150. I am personally quite angry for 2 reasons:

1. Media have wrongly phrases their articles on CS, creating some spiraling sentiment and again, uncorrelated from fundamentals. I even heard again this morning in a French radio that CS was fragile and this honestly drives me mad.

2. Although CS received a welcome sign from SNB and FINMA yesterday, this could have come earlier to stem the pressure. Same for our main shareholders who could have highlighted again, with detailed approach, the strong financial position and the ongoing restructuring and its benefits.

Those could have helped to keep trust intact and slash unfounded rumors. […]”

Realizing that he had made a typo that might have caused confusion for Julian, the relationship manager sent a follow-up email a few hours later:

Dear Julian,

AN UNWELCOMED TYPO : i meant at least on our side, we haven’t seen material outflows in Q1. In between LCR even improve from 144 to 150

Kind Regards, […]

After receiving reassurances from the Credit Suisse employee, Julian decided to purchase nominal USD 200,000 of a CSG AT1 bond (ISIN USH3698DDQ46) at a discounted price of USD 93,077.55, including fees and advance interest.

However, just three days later, on March 19, Julian found out that he had lost his money. Like many other investors, he was in total disbelief.

Julian couldn’t comprehend how the AT1 bonds were written down despite claims from Credit Suisse and Swiss public authorities that the bank had met all regulatory requirements. Little did Julian know at the time that the reality was quite different.

Indeed, it will emerge from the FINMA report dated December 19, 2023 entitled “Lessons Learned from the CS Crisis”, p. 36, that the outflows in the week of March 13-17, 2023 were very substantial, more precisely: CHF 1.6 billion on Monday, March 13; CHF 2.7 billion on Tuesday, March 14; CHF 13.2 billion on Wednesday, March 15; CHF 17.1 billion on Thursday, March 16 and CHF 10.1 billion on Friday, March 17. It will also emerge that the impact of these massive outflows caused “counterparties to demand additional collateral”.

It is clear, then, that the Credit Suisse’s relationship manager had lied.

But the relationship manager is not the only one who lied to Julian. The truth is that everyone, at all levels, lied blatantly about Credit Suisse’s situation during the week of March 13, 2023.

Here are some shining examples:

1) March 14, 2023, Bloomberg Television: Ulrich Körner states that the bank “had received material inflows on March 13”. Körner emphasized furthermore that Credit Suisse’s “liquidity coverage ratio” was “strong, very strong” and “getting stronger as we speak”. He also mentioned that the liquidity situation had improved since the end of 2022, with the liquidity coverage ratio rising from 144 to 150.

This statement is materially false: in fact, we know that on March 13 and 14 there were more than 4.3 billion outflows. Therefore, the increase in the LCR is also unrealistic. Moreover, as FINMA pointed out in its report of December 19, 2023, p. 36, we know that the large outflows had alarmed Credit Suisse’s counterparties causing them “to demand additional collateral”.

2) March 14, 2023, CSG issued its “2022 Annual Report”, signed by Axel Lehmann and Ulrich Körner, stating (p. 107):

Our approach to liquidity risk management

Our liquidity and funding policy is designed to ensure that funding is available to meet all obligations in times of stress, whether caused by market events or issues specific to Credit Suisse. To address short-term liquidity stress, we maintain a liquidity pool, as described below, that covers unexpected outflows in the event of severe market and idiosyncratic stress. Our liquidity risk parameters reflect various liquidity stress assumptions. We manage our liquidity profile at a sufficient level such that, in the event we are unable to access unsecured funding, we expect to have sufficient liquidity to sustain operations for a period of time in excess of our minimum limit.

It is shocking, first of all, to have to mention that in its annual reports, CSG has used virtually identical wording for more than a decade. Even though the financial blowouts experienced by the bank in recent years showed that its approach to risk was wholly unsatisfactory, no supervisory authority in the countries in which the bank operated ever remarked that its annual report was wholly uncritical on the point, never treasuring its mistakes and always repeating the same old rut. Only the report for 2023, published in 2024, had, for obvious reasons, undergone a radical restyling.

Whatever the case may be, such a statement, as of March 14, 2023, in light of the heavy outflows and the very serious loss of confidence, could certainly no longer be considered either current or realistic, as, moreover, admitted by Körner himself and Lehmann at the Credit Suisse shareholders’ meeting held on April 4, 2023.

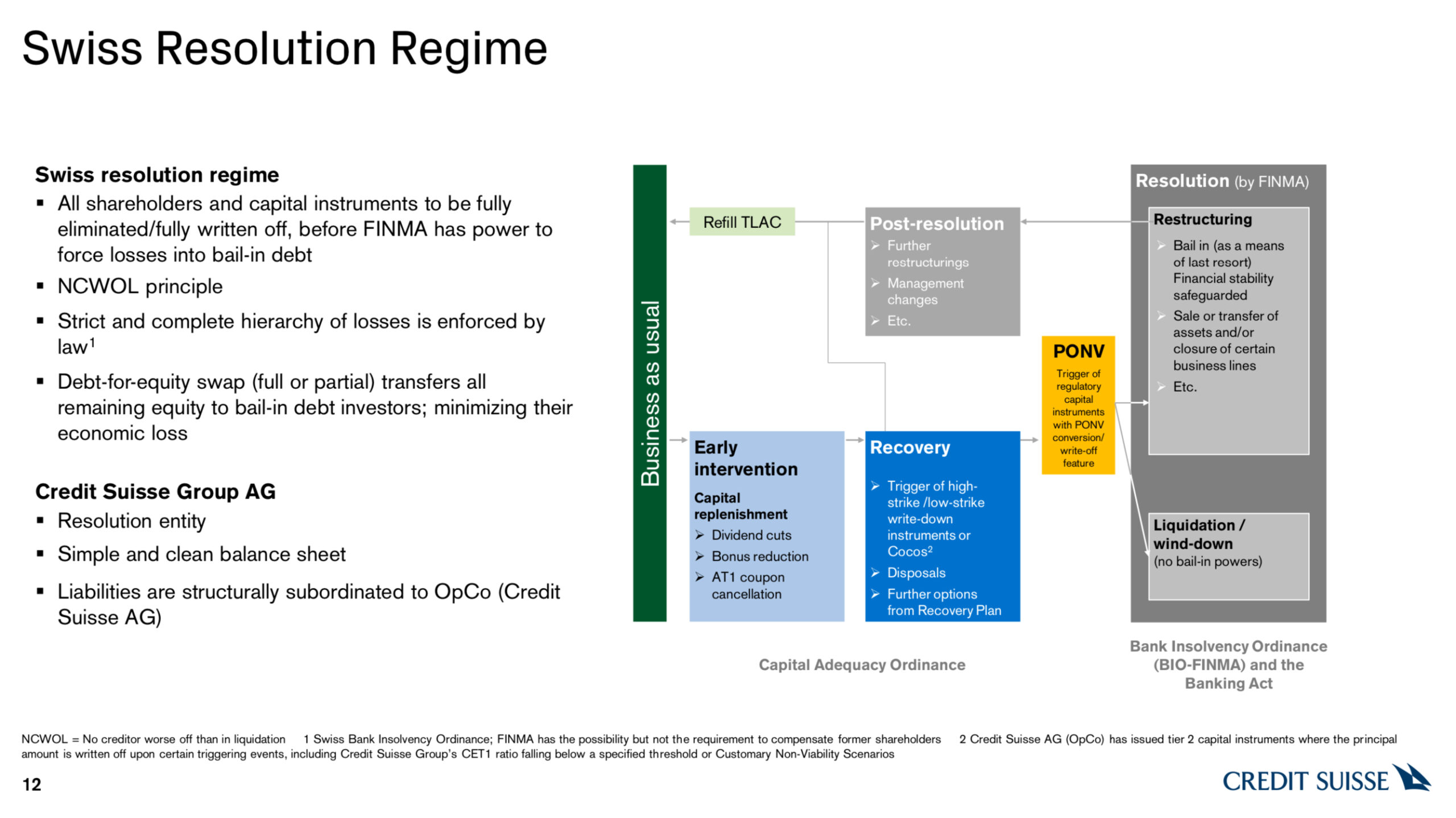

3) March 14, 2023, the CSG “Fixed Income Investor Presentation”, also posted on its website at the following URL: https://www.credit-suisse.com/media/assets/about-us/docs/investor-relations/debt-investors/fixed-income-investor-update.pdf. On page 11 of the presentation, a slide named “Swiss bail-in regime: build-up of HoldCo debt layer reduces loss given default and supports credit rating” described the “Bail-in hierarchy in Switzerland”. In that hierarchy highlighted by Credit Suisse, it was indicated that in the case of a “point of non-viability” the “Loss absorption waterfall” provides for equity capital to respond in the first instance, and only secondarily would AT1 and AT2 capital buffers be called upon. Although, in the same document, there is the classic fine print (curiously absent in previous versions), written in small font and in a hazy color and with a very ambiguous meaning: “insofar as not converted/written-off, prior to restructuring based on terms”, the ambiguity remains in the next slide (p. 12), named “Swiss Resolution Regime”. It states that: a) “All shareholders and capital instruments to be fully eliminated/fully written off, before FINMA has power to force losses into bail-in debt” and b) the NCWOL Principle (no creditor worse off than in liquidation) applies. Ambiguity also strongly reinforced by the fact that Credit Suisse, a few days after the March 19, 2023 press conference, mysteriously made the presentation disappear from its website.

But that is not all. On page 8 of the same presentation, there is a slide named “Decisive actions have rebuilt liquidity coverage ratio from lower levels in the quarter”. Credit Suisse stated that it had taken decisive actions to rebuild its LCR to 144% as of the end of 2022. It further stated that its LCR compares favorably to its peer group and “further substantial liquidity release is expected from the strategic transformation through 2023 as announced in October 2022, including from the Non-Core and Securitized Products”. However, even considering the disclaimer contained in the presentation, the information reported therein is materially false: on March 14, 2023, the date the presentation was published, Credit Suisse was fully aware of the massive outflows, and therefore, in light of their impact, knew that the figures presented were completely unrealistic.

4) March 15, 2023, Financial Sector Conference in Riyadh: Axel Lehmann in a televised speech stated that Credit Suisse had already “taken its medicine” and had been “significantly de-risking its balance sheet” for more than five months, and was essentially ahead of the curve in dealing with potential liquidity issues. Regarding the possibility of accepting the government assistance, Lehmann stated unequivocally:

That’s not a topic. Look, we are regulated, we have a strong capital ratio, a very strong balance sheet, we are all hands on deck, so that’s not a topic whatsoever

As FINMA determined in its December 19, 2023 report (p. 43), Credit Suisse’s strategic revisions had fallen short and not achieved their intended purposes:

Ultimately, the bank’s strategy was no longer able to convince investors and clients. CS had made too few far-reaching changes over the years, and the measures and strategy adjustments presented by CS in October 2022 came too late (‘too little, too late’)

Lehmann thus gave a misrepresentation of reality, making it appear that the bank did not need a loan from SNB. In reality, Credit Suisse had accepted CHF 50 billion in government assistance just a few hours after Lehmann made this statement.

5) March 15, 2023, CNA’s Asia Tonight: Körner told that Credit Suisse was not another SVB because it was subject to higher liquidity and capital requirements. He then assured the market that Credit Suisse was not having liquidity issues, stating that “we fulfill, and overshoot basically, all regulatory requirements. Our capital, our liquidity basis, is very, very strong”.

Also on the CS Twitter feed:

Our CEO, Ulrich Körner, spoke to Channel News Asia reiterate the key points of the Credit Suisse’s strategy and the latest developments. He stated ‘We are a strong bank. We are a global bank, under Swiss regulation. We fulfill and basically overshoot all regulatory requirements. Our capital, our liquidity basis is very strong”

Körner’s statements also created the false impression that Credit Suisse did not need liquidity. Indeed, just a few hours later, the Swiss government offered, and Credit Suisse accepted, billion of CHF in government-provided liquidity.

6) March 15, 2023, in the evening: FINMA and SNB joint statement

FINMA and the SNB issue statement on market uncertainty

The Swiss Financial Market Supervisory Authority FINMA and the Swiss National Bank SNB assert that the problems of certain banks in the USA do not pose a direct risk of contagion for the Swiss financial markets. The strict capital and liquidity requirements applicable to Swiss financial institutions ensure their stability. Credit Suisse meets the capital and liquidity requirements imposed on systemically important banks. If necessary, the SNB will provide CS with liquidity.

FINMA and the SNB are pointing out in this joint statement that there are no indications of a direct risk of contagion for Swiss institutions due to the current turmoil in the US banking market.

Regulation in Switzerland requires all banks to maintain capital and liquidity buffers that meet or exceed the minimum requirements of the Basel standards. Furthermore, systemically important banks have to meet higher capital and liquidity requirements. This allows negative effects of major crises and shocks to be absorbed.

Credit Suisse meets regulatory capital and liquidity requirements

Credit Suisse’s stock exchange value and the value of its debt securities have been particularly affected by market reactions in recent days. FINMA is in very close contact with the bank and has access to all information relevant to supervisory law. Against this background, FINMA confirms that Credit Suisse meets the higher capital and liquidity requirements applicable to systemically important banks. In addition, the SNB will provide liquidity to the globally active bank if necessary. FINMA and the SNB are following developments very closely and are in close contact with the Federal Department of Finance to ensure financial stability.

In its report dated December 19, 2023, p. 37, FINMA states (by way of excusatio non petita) that it made this statement “on the basis of the key figures available to it on March 15, 2023”. FINMA falls into contradiction, however, because in the other parts of its report, for obvious purposes, it repeatedly stated that it was in very close contact with Credit Suisse and had access to all information (indeed, it even emphasizes this in the joint statement above “FINMA is in very close contact with the bank and has access to all information relevant to supervisory law”). Therefore, it is very hard to believe that FINMA did not know that on March 13 and 14 there had been outflows of 4.3 billion and that on March 15 the outflows were massive (13.2 billion) also because Credit Suisse certainly received the wire transfer/closing account orders, given the amounts involved, long before it had materially executed them, so that FINMA certainly had a clear picture of what was happening. Especially since FINMA had been preparing at least since 4Q 2022 for a doomsday scenario, as indeed it admitted in its December 19 report.

Whatever the case, the FINMA and SNB joint statement seems unrealistic and misleading, considering that it omits to shed light on outflows (past and ongoing) and liquidity buffer risks, painting SNB’s willingness to provide liquidity to the CS as a mere possibility (“if necessary”). The question is a must: beyond the actual formalization of the loan agreement, when did the first informal request come from Credit Suisse and when did the informal approval come from the authorities involved? Before or after the joint statement by FINMA and SNB?

A leopard cannot change its spots…

FINMA also refrained from correcting Körner’s and Lehmann’s bold statements on outflows and liquidity, even though Axel Lehmann was by no means new to such reckless utterances:

December 1, 2022, Financial Times Interview: “It was a storm in the retail and partially in the wealth management segment, in particular in Asia, where we had really massive outflows for two to three weeks”. “The good part of the sad story is we had very few clients leaving. They are still with us, they still continue to do business with us”. “I have anecdotes from clients and I know that the money will certainly come back over time”

December 2, 2022, Bloomberg Interview: The outflows have “basically stopped”

December 5, 2022: SFR Interview: “The business is definitely stable”

FINMA had previously launched investigations into Lehmann’s statements, which resulted in nothing, but the Swiss regulator had publicly clarified that “However, it has set out clearly what it expects of the bank regarding its future communications” (FINMA press release March 10, 2023). Moreover, it is unknown whether the investigation has resumed in light of the new statements.

7) March 15, 2023 Federal Councillor Karin Keller-Sutter interview with NZZ

Die CS hat die regulatorischen Kapital- und Liquiditätsanforderungen immer erfüllt

(CS has always met regulatory capital and liquidity requirements)

Again, Keller-Sutter is silent about Credit Suisse’s actual situation, particularly its liquidity problems due to outflows and the fact that evidently the government had already endorsed an extraordinary loan to Credit Suisse.

8) March 16, 2023, CSG press release announced that the bank had obtained CHF 50 billion in liquidity from the Swiss National Bank by availing themselves of Emergency Liquidity Assistance (ELA). Credit Suisse also revealed that it intended to use part of the loan to repay some of its AT1 bonds and published a list of the bonds subject to repayment. The news of the disbursement of a CHF 50 billion loan was also confirmed several times by Swiss Federal Councillor Karin Keller-Sutter.

Once again, the information fed to the press and investors is misleading.

In reality, instead of CHF 50 billion, CSG received only CHF 39 billion through the ELA. For the remaining part, CSG had been unable to provide the collateral required by this financial rescue instrument (which has a meager cost for the bank of 0.5 percent spread). Therefore, on March 17, Credit Suisse had to borrow the remaining part of the required amount using the ELA-Plus bailout facility, which is much more costly (3% spread). Moreover, FINMA had, in truth, opposed the repayment of the AT1s (evidently because their fate, in the Swiss regulator’s intentions, was already sealed long ago).

To all this should be added the offers by Saudi National Bank and Blackrock to buy CSG that was rejected “for the good of the country” by the Swiss Confederation even though they were far more generous than UBS’s and provided for the saving of the AT1s; the code of silence of the speakers during the press conference on March 19, 2023, who avoided admitting to the media that they had just decided to write down CHF 16 billion of AT1s, as if this were a totally negligible detail; and, lastly, the actions taken in all secrecy by former Swiss federal minister Ueli Maurer (reported last Sunday by the Sonntagszeitung), who failed to inform the government and special committees about the true state of Credit Suisse’s health.

In short, an unbelievable tower of plots and lies that not only doped the markets by artificially manipulating CSG stock and bond prices, but more importantly caused direct harm to investors: both to those like Julian, who decided to invest during the final week before the collapse of CSG only because the “positive” announcements reassured them about the bank’s financial health (and who otherwise would never have dreamed of doing so); and to those who had invested well before the crisis and who decided not to sell (thereby reducing their losses) only because they too were reassured by the false news cunningly spread by all the people mentioned above.

The e-mails of the Credit Suisse relationship manager published by antigua.news raise the suspicion that a systematic pyramidal disinformation strategy was in place, which started from the highest echelons of Credit Suisse (Lehman and Körner), and which could count on the support of the Swiss Finance Ministers (Keller-Sutter and Mauer), FINMA and the SNB, trickling down to the lowest levels of the bank’s staff, i.e., those who had direct contact with clients. And the mission was clear and unquestionable: to prevent outflows and disinvestment at any cost because for some time (at least since October 2022), the sacrificial lambs had already been designated, whatever legal scenario the authorities chose.

But back to Julian. He understandably feels cheated and decided to file a criminal complaint with the Zurich Cantonal Police. A lawyer was not assisting him and he is not trained as a jurist, but he had full confidence in the investigators’ work and willingness to investigate.

In his letter, Julian did not attach the email exchange with Credit Suisse or expose all the falsehoods (more than notorious) we have listed above. However, he wrote that he remained available to the investigators to be heard and to tell his truth. His complaint had a clear moral connotation, but he expected the investigators to do their part because such should be their duty.

Instead, the Canton Zurich Prosecutor’s office limited itself to the bare minimum. Without even hearing Julian and without even questioning the criminal relevance of all the misrepresentations set forth above, it simply dismissed the matter by saying, in a nutshell, that in any case there can be no fraud in the wiping out of AT1s because an ad hoc emergency law (Art. 5a LiqH-NVO/PLB-EO) had authorized FINMA to act in this way. No need to investigate further, no need to forward the case file, for reasons of competence, to the Office of the Attorney General of the Swiss Confederation, nor to proceed to further consideration. Case closed. That’s it.

The Credit Suisse case is such a warning sign for a rule of law that no one listens to it.

But how is it possible that in Switzerland the behavior of Lehmann, Körner, FINMA & Co. does not outrage anyone, not for a day, not for a minute?

Definetly a red flag for rule of law, quite unsettling. A big mask has fallen. If this was possible, what could come next?

Simply shameful

Great article. Thanks

Unbelievable